UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a - 101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| |

ox | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

xo | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Herman Miller, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| x | No fee required. |

| | |

| o | Fee computed below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: o |

| | (2) | Aggregate number of securities to which transaction applies: o |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): o |

| | (4) | Proposed maximum aggregate value of transaction: o |

| | (5) | Total fee paid: o |

| | | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

August 30, 201628, 2018

Dear Shareholder,

On February 5, 2018, Herman Miller announced that Brian C. Walker planned to retire as President and Chief Executive Officer and a member of our Board of Directors by August 31, 2018. Following the announcement, our Board established a CEO Search Committee composed of independent directors to identify and evaluate internal and external candidates. To begin the search process, the Search Committee created a CEO profile outlining desired qualities relating to cultural fit and leadership style, differentiating competencies, motivational fit and experience.

To assist in identifying potential candidates based on the desired CEO profile, the Search Committee selected the search firm of Korn Ferry, who identified a number of external candidates. Upon evaluation of the final slate of impressive candidates, the Search Committee selected Ms. Andrea Owen as its recommendation to the Board of Directors to become the new President and Chief Executive Officer and a member of the Board of Directors. After careful consideration, the Board approved the Search Committee’s recommendation.

Prior to joining Herman Miller, Ms. Owen enjoyed a 25-year career at Gap Inc., where she most recently served as Global President of Banana Republic, a division of Gap Inc., leading 11,000 employees across over 600 wholly-owned and franchise specialty and outlet stores in over 27 countries. During her tenure at Gap, her career spanned many verticals and brands within the global business. She developed a diversified skillset that aligns with the strategic direction of Herman Miller today, ranging from digital and omnichannel transformation to design, product development and supply chain management. Ms. Owen achieved impressive results with a strong focus on building people-first teams centered on the values shared by Herman Miller today. Her background demonstrates that she will be able to effectively serve as a market visionary, performance strategist, change sponsor and organization builder at Herman Miller.

As we look ahead, Ms. Owen will be focused on solidifying the momentum of our business and identifying opportunities that will lead to growth in new markets for both contract and consumer customers. The Board and I are confident that Ms. Owen, in partnership with our existing leadership team, is the perfect candidate to take our portfolio of brands to the next level and to seize opportunities that will ultimately unearth long-term value for our shareholders.

Please join me in welcoming Ms. Owen to the role and we thank you for your continued commitment to Herman Miller.

Sincerely,

Michael A. Volkema

Chairman of the Board

August 28, 2018

Dear Fellow Herman Miller Shareholder,

It’s no coincidence that over the last 50For several years now, we’ve had a clear vision to transform Herman Miller has been at the centerinto a global provider of virtually every game-changing innovation the office furniture industry has seen - and we’re just getting started. At the heart of Herman Miller has always been a culture motivated by a sense of purpose and ownership; and driven to create inspiring designs to help people do great things. AsWe have focused on expanding our addressable markets and creating new channels of distribution to serve our customers. This strategy includes five key priorities, which I will provide an update on shortly. Achieving this vision requires imagination, stretches our resources, and pulls us to constantly re-examine what we lookdo and how we do it. I’m proud that Herman Miller’s 8,000 employees continue to respond with the future, we’ve combinedspirit and creativity that have propelled Herman Miller for more than 100 years.

Sales of $2.38 billion for fiscal 2018 marked a powerful familyrecord level for the third year in a row and reflected growth across each of our business segments. The organization did a great job of managing operating expenses over the full year, helping to mitigate gross margin pressures. We reported EPS on a GAAP basis of $2.12 for fiscal 2018, and adjusted EPS of $2.30(1) increased by 6% over the prior year. Reflecting the strength of our current financial position and confidence in our growth strategy, we announced a 10% dividend increase in July.

Our business and the realities our customers face continue to evolve. The following five key priorities aim to help us create value for both our customers and Herman Miller, and we made meaningful progress on each of them over the past year.

Realize the Living Office

The Living Office is a research-based framework to help our customers design compelling, high-performing work spaces and a critical foundation for setting our innovation agenda and leveraging our dealer eco-system. In the past year, we added significantly to our research into workplace environments, and through a combination of partnerships and a new range of technology-focused work space settings, we are integrating technology more powerfully than ever before. We also launched the Live OS technology platform to improve workplace performance and help achieve wellness goals with real-time data.

Deliver Innovation

Innovation remains at the forefront for Herman Miller. Sales from new products in 2018 reflected 29% of total sales for the year, well above our annual target of 20%. We launched 46 new products in the past year and announced a number of upcoming launches at the NeoCon industry tradeshow this past June. These launches included Cosm, a performance task chair designed by our long-time design partner in Berlin, Studio 7.5., that won a Best of NeoCon Gold award in the ergonomic seating category for its innovative design. Altogether, our new products have the Herman Miller and dealer sales teams energized and well-positioned for the opportunities ahead.

Leverage our Dealer Eco-system

Strengthening our dealer eco-system remains a focal point. We expanded our product offerings into growing categories like performance seating and enclosures. The seating launches of Cosm, Verus, and Lino expand our leading line-up of seating designs. With the recently announced investment in Maars Living Walls, a global leader in interior wall solutions; the launch of Overlay, a system of sub-architectural, moveable walls; and an alliance with Framery, a provider of high performance soundproof enclosures, we have made a strong push into the enclosures category. The Herman Miller Elements team continues to help our dealers fully understand the breadth of our offering across the Herman Miller group of brands a commitmentin the fast-growing ancillary space. To further support our dealers, we’ve made significant progress this year enhancing our digital tools to innovationmake it as easy as possible for dealers to order, specify, and an unrivaled global distribution channelvisualize the entire product offering across all of our group of brands. We’ll continue to position ourselvesenhance these tools with new search and visualization features planned for growth.the year ahead.

Scale our Consumer Business

Fiscal 20162018 was a year of significant accomplishments towardsgreat progress scaling our long-term goals. WeConsumer business. Revenues grew by 12% over last year, as comparable brand sales increased saleseach quarter and we expanded selling space by 40,000 square feet. Our mix of exclusive modern designs also continues to grow. Finally, our June investment in fiscal 2016HAY, a Denmark-based design leader in ancillary furnishings in Europe and Asia, supports our priorities around scaling our Consumer business and the Dealer Eco-System. Active in both the contract and residential furnishing markets, the HAY brand expands our portfolio of leading global brands and allows us to scale the Consumer business by 5.7% to $2.26 billion, an all-time record level of sales for our company,accessing a growing customer base that prizes both industry-leading design and grew adjusted earnings per share by 19%(1) compared to last year. These results are a clear tribute to the talent and effort of our people. I would like to highlight the meaningful progress we made on a number of important priorities during the past year.

Expand sales knowledge base

value. Over the past few years we have significantly increased the breadth of our solution set to respond to the changing landscapecourse of the modern work place. This pastcoming fiscal year, we made a significant investment in training and education for our dealers, and sales and design professionals. Specifically, we created and implemented a series of “Bootcamps” that markedly increased our commercial teams’ knowledge of our expanded offer and provided the tools they need to win.

Align sales deployment model

Next, we re-engineered our sales deployment model to ensure we are best aligned to serve our dealers and increase our share of their business. To get there, we developed and launched a new Channel Sales Manager role and team. This team is responsible for the geographic deployment of all of our brands and capabilities to our dealers. We are really excited by the early progress of this team and think it holds great promise.

We reorganized our sales efforts around Healthcare, Government and Education; changes that led to better coverage of opportunities and better alignment of skill sets, enabling us to put additional resources on the largest healthcare and government organizations. We’ve already seen results, and these changesHAY’s goods will pay great dividends as we offer all of Herman Miller's expanded capabilities to these large and complex organizations.

Increase innovationbe available through enhanced new product commercialization process

Given our expanded, addressable market and the accelerated pace of change in our customers lives, we need to increase the size of our innovation pipeline and reduce our time to market. To achieve this objective, we began the implementation of a plan that includes the creation of an “innovation kitchen” to increase our ability to source and evaluate innovative ideas. In addition, we streamlined our organizational structure and processes for managing our new product commercialization process. We believe these changes will increase the speed of decision- making and ensure we have improved balance between short cycle product improvements, new platforms and breakthrough innovation. This year at NeoCon, we launched in excess of 20 new products, including products from our R&D studios in Herman Miller, Geiger, The Collection, Nemschoff, Herman Miller U.K., and Maharam. The breadth and quality of this work was impressive, and we were recognized with a number of awards. Even more important, we have a robust pipeline full of new ideas that will continue to produce new products for us over the coming years.

In addition to reorganizing internal development, we recently announced a strategic partnership with U.K.-based, Naughtone. This partnership will augment our offering of furnishings for areas in work environments beyond our historical focus on individual work stations. Naughtone will also add to the operational capabilities needed to serve the EMEA region.

Enrich the way customers experience Herman Miller

We have been implementing a multi-year plan to create the best customer experience in our space. This includes a dealer branding campaign, upgrades to our global showroom portfolio and converting our Design Within Reach studio portfoliochannels. HAY products will also be integrated into the contract furnishings business across our dealer network as part of the Herman Miller family of brands.

Drive Profit Optimization

We made progress this year on our corporate-wide profit optimization goal, our fifth strategic priority. Given inflationary pressures over the past year, this work, combined with pricing actions we implemented in the third quarter of fiscal 2018 and a planned price increase in January of 2019, is proving to be critical to helping to address those pressures and drive improvements in operating margins. Across three phases of work

that are in progress, we are building line of sight toward achieving between $60 million and $90 million of profit optimization, including run rate savings of approximately $30 million that we have generated to date.

Let me provide more perspective on each of the phases. The initial corporate-wide push that we began 18 months ago has generated a larger footprint.run-rate of $23 million of annual savings to date and we believe will realize another $5 million from our recent manufacturing consolidation efforts. In August of 2017, we also began a focused initiative aimed at profit optimization within our Consumer business. We believe we can drive $15 million to $20 million of profit improvement in the Consumer segment as part of our drive to achieve sustained operating margins of 8% to 10% in that business. This includes $2 million of initial benefits realized in the fourth quarter in fiscal 2018. As most of the benefits of the work to date have been offset by increased inflation and discounting, we have recently increased the scope of our efforts to include the North America business. While we are still in the opportunity confirmation stage, we see the potential for $20 million to $40 million of benefit based on the distinct work streams identified to date. All together, these phases will be critical in helping us fund growth initiatives, offset potential inflationary pressures and, ultimately, achieve or exceed our goal of consolidated operating margins of 10% by the end of this fiscal year 35%2020.

We made important progress on all five strategic priorities in the past year. As we enter fiscal 2019 with tremendous momentum toward delivering sustainable, profitable growth for our stakeholders, these five priorities will remain a focus for us. At the same time, we will support these priorities with three additional areas that will require our attention, effort and investment.

First, we must increase our efforts and commitment toward building an inclusive and diverse culture. Diverse perspectives, thoughts, and experiences are critical to attracting and keeping the best talent, as well as to understanding the diverse perspectives and needs of our United States dealers had implementedcustomers. While this is not new to us, we are committed to continuing to grow in this area. We’re building intentionality and purpose into everything we do to ensure we’re creating systems that afford every person at Herman Miller the new brand standardsopportunity to achieve their full potential.

The second area we are ramping up is modernizing our manufacturing capabilities. The first step is to stabilize our core competencies and bring our capacities in their markets. Last year,line with market demands. This work is well underway. We’re in the process of resetting our footprint in China by consolidating the Dongguan and Ningbo plants, and in the U.S., we reset eachhave approved nearly $100M in investments to modernize our capabilities. Along with stabilizing our core, we must also further integrate technology with our manufacturing equipment and processes. Increasing computing power, combined with proven manufacturing techniques, will help us redefine what’s possible. We’ll build the next stage of our global showroomslean journey by incorporating automation into all of our thinking.

Last, and a more long-range objective, is “becoming a digital enterprise.” This begins with a shift in perspective. Our information technology teams are moving from a “boxes and wires” focus to reflect our best thinking of what is required to create an inspiringhelping drive growth as digital business partners. This work placewill build on the progress we have already made and demonstrate our expanded portfolio of solutions. This past year,will happen in four areas. First, we opened new showrooms in Washington, D.C.are simplifying and New York. The New York showroom is our first flagship location and unites our Herman Miller, Geiger, Collection and Maharam brands. This location includesexpanding the first Herman Miller branded retail studiodigital highway in the United Statesdealer eco-system. Second, we are expanding our digital service offering with platforms like Live OS. Third, artificial intelligence, data, and serves asvisualization tools will help us become better at core competencies like customer service, training, and design. Finally, technology will help us with the home for our talented team in this region.modernization of manufacturing.

PositionConsidering the Consumer business for future growth

While we experienced growing pains in our Consumer business this yearwide and have more work to do, we continue to believe the strategic drivers that led us to invest in this segment are a great opportunity for us. These factors include the convergencedeep array of workproducts, capabilities, and home environments, the power of a multi-channel capability to increase our addressable market, and the permission consumers have givenbrands now available from the Herman Miller brand to serve them.

A numberGroup and a clear set of actions this year havepriorities for the work ahead of us, well-positioned to connect with consumers and growwe’re more confident than ever in this market. A core partour future. The diversity of our Consumer strategy continues to beportfolio and the transformation of our Design Within Reach studio portfolio. The primary objective is to improve the customer experience with larger studios that enable the customer to envision a modern living environment and showcase our expanded portfolio of products. This past year, we opened new studios in Scottsdale, Arizona, and Berkley, California. To be frank, this was below our plan of opening six new studios. Overall the number of studios declined this past year from 33 to 29,and our total square footage was essentially flat. Whilecapabilities we are never happy missing an objective, we believebuilding within the team made the right long-term decision to be selective about location, and they’ve built a strong backlog of new studios to open over the next 12 to 18 months. We enter fiscal 2017 with nine new or expanded studios under contract and in our plans.

We made significant investments in brand awareness and customer acquisition. These efforts included a mobile-optimized web platform and rolling out a new sourcebook to highlight the breadth of our offer for the design trade channel. We have also started to introduce the Design Within Reach offer to our contract dealers. In addition, we have taken proactive steps to improve the effectiveness of our catalog program, which continues to be an important driver of customer acquisition.

Finally, we implemented a new ERP system during the second quarter of the year. We believe this investment, along with improvements we are making in logistics, will improve efficiency, enable our sales professionals to better serve their customers, and improve the customer’s experience from purchase to delivery.

New and enhanced operational capabilities

We opened new operational facilities in the United Kingdom and India to improve operational efficiency and our ability to serve customers and dealers in EMEA and Asia. In Melksham, U.K., our new Portal Mill facility combines manufacturing and distribution under one roof, replacing the buildings we had outgrown in Bath and Chippenham. Over the past few years, we have built a strong dealer channel to serve the fast growing Indian market. This past year we opened a new manufacturing and distribution facility in Bangalore, India, to complement our regional manufacturing capabilities in China. This capabilityHerman Miller community will enable us to improveprovide our response timecustomers with the most comprehensive solutions to customersmeet their needs in working, living, healing, and improvelearning environments.

On a personal note, as Herman Miller moves with commitment toward the competitiveness of our offer.

Deliver on the promise of Living Office

We made a number of steps which will enable us to deliver on the promise of the Living Office, our comprehensive approach to workplace design. We began to roll out a number of case studies that demonstrate how the application of the Living Office can improve our customers' businesses and the lives of their people. One very promising new facet of our ability to deliver Living Offices involves connecting people and organizations digitally with their workplace. We developed a number of new products and partnerships that will enable us to deliver on our strategy of the connected and quantified office: Smart Furnishings, Smart Settings, and Smart Places. These intriguing new products and digital connections combine productivity with better health, put in place customized adjustments at the work station level, and allow individuals to use our products-especially their ergonomic features-with much greater effect. We envision dashboards that provide organization’s analytics on the health of employees and the utilization of facilities. These capabilities, combined with our growing breadth of solutions beyond the workstation, significantly enhanced our ability to deliver on the promise of the Living Office we introduced four years ago.

Taking our Shift strategy togoals mentioned above, a new level

FiveCEO will see us achieve them. After a career of 29 years ago we beganand a tenure of 14 years as CEO, I will be retiring in August 2018. My time at Herman Miller has been an inimitable period of wonderful relationships, great personal growth, and tremendous learning. I’m humbled to pursuejoin the list of Herman Miller leaders, and I’m still awed by the chance I was given to help this great community change and grow. With the announcement of Andrea Owen as the next CEO of Herman Miller, I am looking forward to working with Andrea through a strategy we called Shift. We adopted this strategy in viewseamless transition. Herman Miller is only just beginning to scratch the surface of enormous and dramatic changes in the ways people work, changes in demographics, technological changes, and changes in our markets. In retrospect, the key changes we anticipated have indeed played out, and they continue to gain strength and impact on our and our customers’ worlds. Our strategy envisioned four shifts we had to make for us to navigate these changes:

From product focus to complete solutions;

From North America-centric to global;

From office products to products for everywhere;

From an industry brand to an industry + consumer brand.

These shifts required us to change our perspective on our business, on our geographies, on our customers and on the ways we portrayed Herman Miller’s products, business and community to the world. These four shifts remain our north star.

This year we have added one additional shift-Product Marketing to Pull Marketing-that we believe is required for us to reach the full velocity of our transformation. In other words, we believe this additional shift will put our strategy into Overdrive, and that is what we have renamed our strategy.

Our performance over the past five years gives us confidence that we are headed in the right direction. We have enlarged our addressable market by almost 50%opportunity. Andrea’s experience driving results as a seasoned leader, coupled with our outstanding leadership team, will take our family of brands to $35 billion in the past five years. We have a unique and incredibly strong global distribution channel in 109 countries, consisting of over 600 dealers, 29 studios, and a growing e-commerce connection to consumers. We have a consistent global brand presence reflected in our buildings, showrooms, retail studios and dealers. We have solidified our position as one of the leaders in design around the world. Now, with all of these major building blocks in place, we believe we can build on our position and achieve sustained levels of growth in sales and profitability.next level.

An ongoing sense of purpose and commitment

Over the last century, Herman Miller has come to stand for many things. Chief among these are a thoughtful, human-centered approach to modern design; revolutionizing the ways people work, learn, heal and live; doing our best for the environment; and thinking differently about how a company and its leaders can serve the people who make it up. These qualities and our ongoing aspiration to exemplify them at Herman Miller will not change.

As we continue our transformation to a modern lifestyle company connected to consumers and organizations around the world, we will bring all the talents and skills of the 8,000 Herman Miller employees to bear on our goals. We promise to pursue our mission-inspiring designs to help people do great things. And we strongly believe that fulfilling our mission will lead us to achieving the goals we have set.

Thanks, as always,Thank you for your faithfulongoing support and interest through your ownership of Herman Miller. I believewish this stage ofcommunity called Herman Miller’s impressive history is one ofMiller only the most exciting periods yet.

best in the future.

Sincerely,

Brian C. Walker

President and Chief Executive Officer

Notice of Annual Meeting of Shareholders

The Annual Meeting of the Shareholders of Herman Miller, Inc. (the “Company”) will be held on October 10, 2016,8, 2018, by means of remote communication on the Internet at www.virtualshareholdermeeting.com/MLHR16,MLHR18, at 10:30 a.m. (ET) for the following purposes:

| |

| 1. | To elect four directors, each for a term of three years |

| |

| 2. | To approve an amendment to our Articles of Incorporation to allow our by-laws to provide for a majority voting standard for the election of directors in uncontested elections |

| |

| 3. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm |

| |

3.4. | To vote, on an advisory basis, to approve the annual compensation paid to the Company'scompany's named executive officers |

| |

4.5. | To transact such other business as may properly come before the meeting or any adjournment thereof |

Shareholders of record at the close of business on August 12, 2016,10, 2018, will be entitled to vote at the meeting.

Please note that this year's Annual Shareholders' Meeting will be held via the Internet only. The accompanying proxy materials include instructions on how to participate in the meeting and the means by which you may vote your shares of Companycompany stock.

We encourage you to vote your Proxy, at your earliest convenience, by one of the following means:

By visiting www.proxyvote.com on the Internet

And if you request paper materials:

By calling (within the U.S. or Canada) toll free at 1-800-690-6903; or

By signing and returning your Proxy card

You may also vote at the meeting via the internet by visiting www.virtualshareholdermeeting.com/MLHR16MLHR18 and following the instructions. Regardless of whether you expect to attend the meeting through the Internet, please vote your shares in one of the ways listed above.

By order of the Board of Directors

H. Timothy Lopez, Secretary

August 30, 201628, 2018

Table of Contents

|

| |

| | Page No. |

| Solicitation of Proxies and Voting (Q&A) | |

| Proxy Statement Summary | |

Financial Highlights from 20162018 | |

| Proposal #1 - Election of Directors | |

| Corporate Governance and Board Matters | |

| Board Committees | |

| Proposal #2 - Approval of Amendment to Articles of Incorporation | |

| Proposal #3 - Ratification of Appointment of Independent Registered Public Accounting Firm | |

| Report of the Audit Committee | |

Proposal #3#4 - Proposal to Approve, on an Advisory Basis, the Annual Compensation Paid to the Company's Named Executive Officers | |

| Voting Securities and Principal Shareholders | |

| Director and Executive Officer Information | |

| Compensation Discussion and Analysis | |

| Executive Compensation Committee Report | |

| Summary Compensation Table | |

| Grants of Plan-Based Awards | |

| Outstanding Equity Awards at Fiscal Year-End | |

| Option Exercises and Stock Vested | |

| Pension Benefits | |

| Nonqualified Deferred Compensation | |

| Potential Payments upon Termination, Death, Disability, Retirement or Change in Control | |

| Director Compensation | |

| Equity Compensation Plan Information | |

| Section 16(a) Beneficial Ownership Reporting Compliance | |

| Certain Relationships and Related Party Transactions | |

| Reconciliation of Non-GAAP Financial Measures | |

Submission of Shareholder Proposals for the 2017 Annual Meeting | |

| Miscellaneous | |

Herman Miller, Inc.

855 East Main Avenue

PO Box 302

Zeeland, Michigan 49464-0302

Proxy Statement Dated August 30, 201628, 2018

This Proxy Statement and the accompanying Proxy, which we are making available to shareholders on or about August 30, 2016,28, 2018, are furnished to the shareholders of Herman Miller, Inc. in connection with the solicitation by the Board of Directors of proxies to be used at the Annual Meeting of Shareholders. This meeting will be held on October 10, 2016,8, 2018, at 10:30 a.m. (ET). Please note that this year's Annual Meeting will once again be held via the Internet rather than in person.

What is a proxy?

A proxy is your authorization for someone else to vote your shares for you in the way that you want to vote and allows you to be represented at our Annual Meeting if you are unable to attend the meeting. When you complete and submit a proxy card or use the automated telephone voting system or the Internet voting system, you are submitting a proxy. As used in this proxy statement,Proxy Statement, the terms “the Company,company,” “we,” “our” and “us” all refer to Herman Miller, Inc. and its subsidiaries.

What is a proxy statement?Proxy Statement?

A proxy statementProxy Statement is a document the United States Securities and Exchange Commission (“SEC”) requires to explain the matters on which we are asking you to vote at our Annual Meeting by proxy and to disclose certain information that may be helpful to you in deciding how to vote. This proxy statementProxy Statement was first made available to the shareholders on or about August 30, 2016.28, 2018.

Why am I receiving my proxy materials electronically instead of receiving paper copies through the mail?

We are furnishing proxy materials to our shareholders primarily via the Internet, instead of mailing printed copies of the proxy statementProxy Statement and annual report.Annual Report. This supports our on-going commitment to sustainability by reducing the amount of paper needed to produce this reportcirculate the proxy material and at the same time reducesreducing our costcosts associated with mailing the proxy materials to shareholders.

On or about August 30, 2016,28, 2018, we mailed to our shareholders of record (other than those who previously requested electronic delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access this proxy statementProxy Statement and our annual reportAnnual Report online. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials in the mail. The Notice of Internet Availability of Proxy Materials instructs you how to electronically access and review all of the information contained in this proxy statementProxy Statement and the annual report,Annual Report, and it provides you with information on voting.

If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a paper copy of our proxy materials, follow the instructions contained in the Notice of Internet Availability of Proxy Materials about how you may request to receive your materials in printed form on a one-time or ongoing basis.

Where is this year’s proxy statementProxy Statement available electronically?

You may view this proxy statementProxy Statement and the 2016 annual report2018 Annual Report electronically by going to www.proxyvote.com.

Who can vote?

Only record holders of our common stock at the close of business on August 12, 201610, 2018 can vote at the Annual Meeting. We refer to that date as the Record Date for the meeting. Each shareholder of record has one vote, for each share of common stock owned, on each matter presented for a vote at the Annual Meeting.

What is the difference between a shareholder of record and a “street name” holder?

If your shares are registered directly in your name on the records of our transfer agent, then you are the shareholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee, then the brokerage firm, bank or other nominee is considered to be the shareholder of record with respect to those shares. However, you still are considered the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the brokerage firm, bank or other nominee how to vote their shares. See “How can I vote?” below.

How can I vote?

If your shares are held in “street name,” follow the instructions provided by your brokerage firm, bank, or other nominee. If your shares are registered directly in your name on our records, you can vote in one of four ways:

Via Internet before the Annual Meeting: Go to www.proxyvote.com and follow the instructions. You may do this at your convenience, 24 hours a day, 7 days a week. You will need to have your proxy card or Notice of Internet Availability of Proxy Materials in hand. The deadline for Internet voting is 11:59 p.m., Eastern Time, October 9, 2016.7, 2018.

By Telephone: CallIf you have requested paper materials, call toll-free 1-800-690-6903 and follow the instructions. You may do this at your convenience, 24 hours a day, 7 days a week. You will need to have your proxy card or Notice of Internet Availability of Proxy Materials in hand. The deadline for voting by phone is 11:59 p.m., Eastern Time, October 9, 2016.7, 2018.

In Writing: If you received a proxy card, complete, sign, and date the proxy card and return it in the return envelope that we provided with your proxy card.

At the Annual Meeting: Log on to the Internet at www.virtualshareholdermeeting.com/MLHR16.MLHR18. At this site, you will be able to vote electronically. You will also be able to submit questions.

If you submit a proxy to the Companycompany before the Annual Meeting, whether by proxy card, by telephone or by Internet, the persons named as proxies will vote your shares as you direct. If no instructions are specified, the proxy will be voted for the four directors nominated by the Board of Directors; for the proposal to approve an amendment to our Articles of Incorporation to allow our by-laws to provide for a majority voting standard for the election of directors in uncontested elections; for the ratification of the appointment of Ernst & Young LLP as the Company’scompany’s independent registered public accounting firm for the fiscal year ending June 3, 20171, 2019; and for the non-binding advisory proposal to approve the compensation of our Named Executive Officers.

Can I revoke my proxy?

You may revoke a proxy at any time before the proxy is exercised by:

(1) delivering written notice of revocation to the Corporate Secretary of the Company,company, 855 East Main Street, P.O. Box 302, Zeeland, Michigan 49464-0302;

(2) submitting another properly completed proxy card that is later dated;

(3) voting by telephone at a subsequent time;

(4) voting via the Internet at a subsequent time; or

(5) voting at the Annual Meeting.

If you hold your shares in “street name,” you must vote your shares in the manner that your brokerage firm, bank or other nominee has prescribed.

How many votes do we need to hold the Annual Meeting?

To carry on the business of the meeting, we must have a quorum. This means that at least a majority of the shares that are outstanding and entitled to vote as of the Record Date must be present in person or by proxy.

Shares are counted as present at the meeting if the shareholder either:

has properly submitted a signed proxy card or other form of proxy (through the telephone or Internet); or

Isis present at the Annual Meeting and votes electronically at the meeting.

On the Record Date, there were 60,010,54059,497,056 shares of common stock issued and outstanding. Therefore, at least 30,005,27029,748,529 shares need to be present at the Annual Meeting.

What matters will be voted on at the meeting?

We are asking you to vote on: (i) the election of four directors to serve three-year terms expiring in 2019;2021; (ii) a proposal to approve an amendment to our Articles of Incorporation to allow our by-laws to provide for a majority voting standard for the election of directors in an uncontested election: (iii) the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending June 3, 20171, 2019; and (iii)(iv) a non-binding advisory proposal on the compensation of our Named Executive Officers, otherwise known as a “say-on-pay” proposal. We describe these matters more fully in this proxy statement.Proxy Statement.

How many votes are needed for each proposal?

Except with respect to the election of directors and approval of the amendment to our Articles of Incorporation to allow our by-laws to provide for a majority voting standard for the election of directors in uncontested elections, a majority of votes cast at the meeting will approve each matter that arises at the Annual Meeting.

The directors are elected by a plurality of votes.votes cast. This means that the four individuals receiving the highest number of votes cast “for” their election will be elected as directors of the Company.company. A “withhold authority” vote will have no effect on the election of a particular nominee. However, our Board's Governance Guidelines include a form of majority voting for directors. Under the Governance Guidelines, in an election where the only

nominees are those recommended by the Board, any director who receives a greater number of votes "withheld" than those "for" must tender his or her resignation. Under the Guidelines, the Nominating and Governance Committee will consider the resignation and recommend to the Board whether to accept or reject the tendered resignation. The Board must act on the resignation no later than 90 days after certification of the shareholder vote at the meeting. The Companycompany will publicly disclose the Board's decision whether to accept any resignation or the reasons for rejecting the resignation, if applicable.

The amendment to our Articles of Incorporation to allow our by-laws to provide for a majority voting standard for the election of directors will be approved if it receives the affirmative vote of a majority of the outstanding shares entitled to vote on the proposed amendment.

If your shares are held by a broker, bank or other nominee, the holder of your shares cannot vote your shares on the election of directors, the proposal to amend our Articles of Incorporation, or the say-on-pay vote unless it has received voting instructions from you. Each of these matters is considered a non-routine matter, and if you fail to provide instructions, the result is a “broker non-vote”.

Abstentions and broker non-votes are counted for the purpose of determining the presence or absence of a quorum. Abstentions and broker non-votes are not, however, counted as votes cast on matters submitted for shareholder vote. However, abstentions and broker non-votes have the effect of a vote "against" the amendment to our Articles of Incorporation to allow our by-laws to provide for a majority voting standard for the election of directors.

What happens if a nominee is unable to stand for re-election?

The Board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. Proxies cannot be voted for more than four nominees. We have no reason to believe any nominee will be unable to stand for re-election.

What alternatives do I have in voting on each of the proposals?

Except with respect to the election of directors, you may vote “for,” “against,” or “abstain” on each proposal. In the election of directors, you may vote “for” or “withhold authority to vote for” each nominee.

Will the Annual Meeting be Webcast?

Yes. You may attend and participate in the Annual Meeting by logging onto the Internet at www.virtualshareholdermeeting.com/MLHR16.MLHR18. At this site, you will be able to vote electronically and submit questions during the meeting. You will need the 12-digit16-digit control number that you received with your proxy card or Notice of Internet Availability to enter and attend the meeting.

Where do I find the voting results of the meeting?

If available, we will announce voting results at the Annual Meeting. We will also disclose the voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to be Held on October 10, 20168, 2018

This proxy statementProxy Statement along with our annual reportAnnual Report are available at: www.proxyvote.com.

You may obtain a copy of the Company’scompany’s Annual Report on Form 10-K for the fiscal year ended May 28, 2016,June 2, 2018, as filed with the SEC, without charge upon written request to the Secretary of the Company,company, Herman Miller, Inc., 855 East Main Street, P.O. Box 302, Zeeland, Michigan 49464-0302.

Proxy Statement Summary

This summary highlights information contained elsewhere in this proxy statement.Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. For more complete information regarding the Company’scompany’s fiscal 20162018 performance, please review the Company’scompany’s Annual Report on Form 10-K for the year ended MayJune 2, 2018.

Proxy Statement Availability and Annual Meeting Information

This Proxy Statement and the accompanying Proxy, which we are making available to shareholders on or about August 28, 2016.2018, are furnished to the shareholders of Herman Miller, Inc. in connection with the solicitation by the Board of Directors of proxies to be used at the 2018 Annual Meeting of Shareholders. This meeting will be held on October 8, 2018, at 10:30 a.m. (ET). Please note that this year's Annual Meeting will once again be held via the Internet rather than in person.

We hold the Annual Meeting via the Internet due to the ease and convenience in attending, which is likely to increase participation levels. We also believe that holding the Annual Meeting via the Internet is beneficial to both shareholders and the company because it eliminates travel costs to shareholders and it eliminates costs to the company associated with holding an in-person meeting.

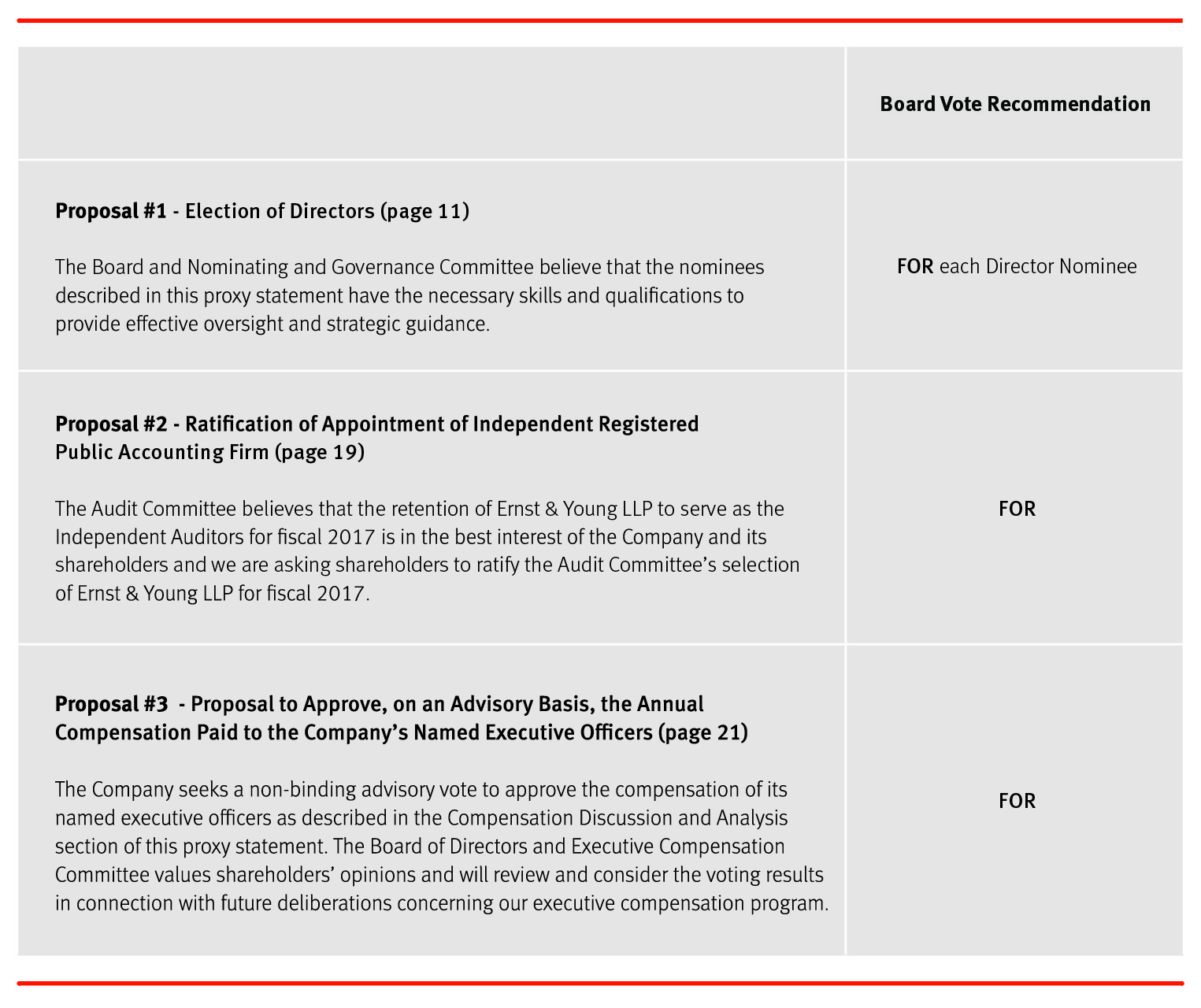

Voting Matters and Board Recommendations

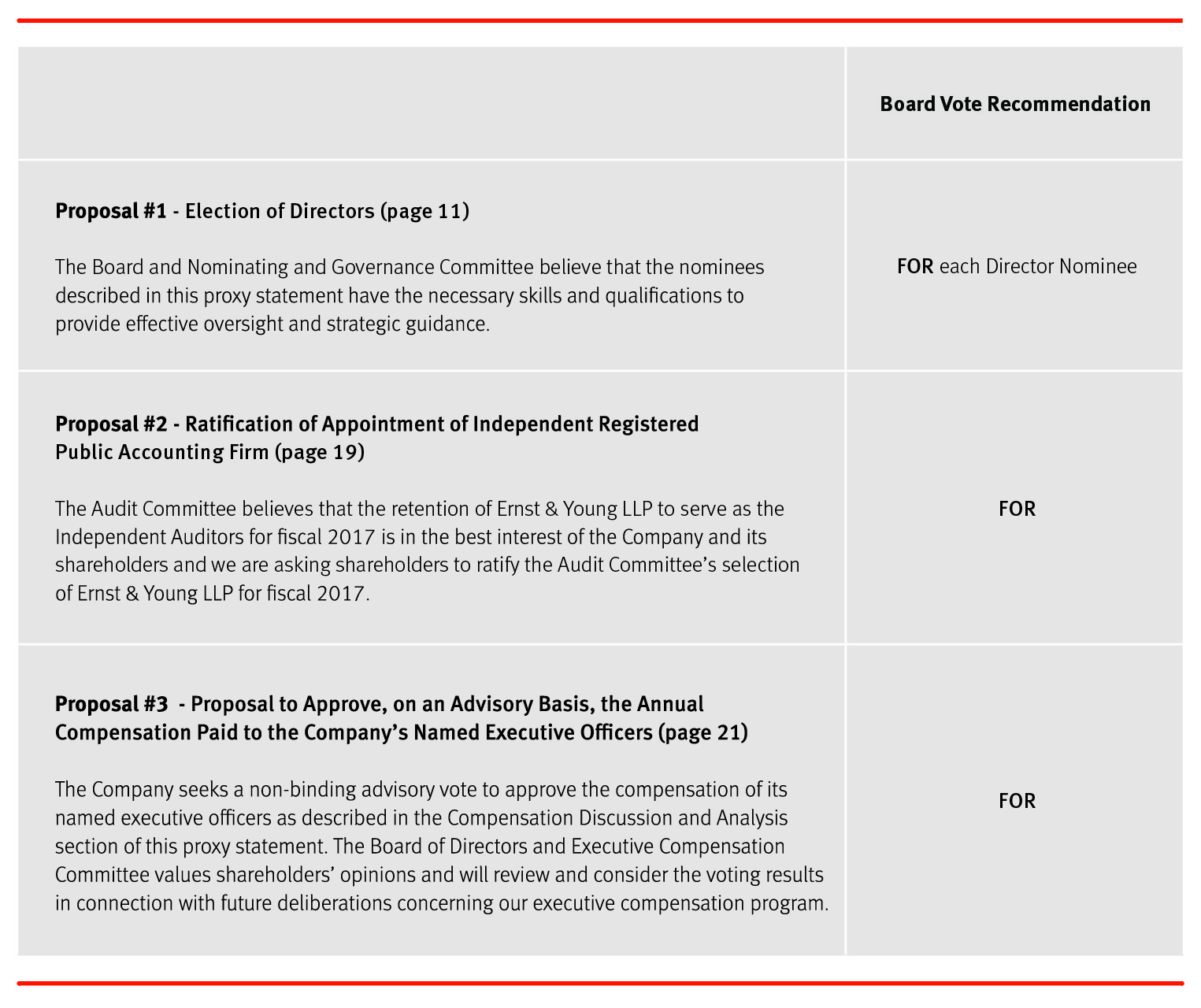

The Board is not aware of any matter that will be presented for a vote at the 20162018 Annual Meeting of Shareholders other than those shown below.

|

| |

| |

| Board Vote Recommendation |

| Proposal #1 - Election of Directors | FOR each Director Nominee |

| The Board and Nominating and Governance Committee believe that the nominees described in this Proxy Statement have the necessary skills and qualifications to provide effective oversight and strategic guidance. |

| Proposal #2 - Approval of Amendment to Articles of Incorporation | FOR |

| The Board has adopted, subject to shareholder approval, an amendment to our Articles of Incorporation that would allow us to amend our Bylaws to provide that, in an uncontested election, a nominee must receive a majority of the votes cast to be elected as a director. Under this proposal, in contested elections, where the number of nominees exceeds the number of directors to be elected, the voting standard would continue to be a plurality of the votes cast. |

| Proposal #3 - Ratification of Appointment of Independent Registered Public Accounting Firm | FOR |

| The Audit Committee believes that the retention of Ernst & Young LLP to serve as the Independent Auditors for fiscal 2019 is in the best interest of the company and its shareholders and we are asking shareholders to ratify the Audit Committee's selection of Ernst & Young LLP for fiscal 2019. |

| Proposal #4 - Proposal to Approve, on an Advisory Basis, the Annual Compensation Paid to the Company's Named Executive Officers | FOR |

| The company seeks a non-binding advisory vote to approve the compensation of its named executive officers as described in the Compensation Discussion and Analysis section of this Proxy Statement. The Board of Directors and Executive Compensation Committee value shareholders' opinions and will review and consider the voting results in connection with future deliberations concerning our executive compensation program. |

| |

Financial Highlights from Fiscal 20162018

Company Performance

Net sales increased in 20162018 to $2.26 billion,$2,381.2 million, an increase of 5.7%4.5% from the prior fiscal year and an all-timea record level of sales for the company. OrdersOn an organic basis, which adjusts for dealer divestitures, changes in foreign currency translation rates and the year were $2.28 billion, a year over year increaseimpact of 6.2%.the extra week in fiscal 2017, net sales increased by 6.5%(1) compared to last fiscal year. Each of our business segments delivered sales growth forover last year, led by double digit growth in the ELA and Consumer segments during the year.

While gross margins were impacted by higher commodity costs, unfavorable product mix and a competitive pricing environment compared to last year, operating expenses were well controlled during the year, despite facing foreign currency exchange headwinds. Strong gross margin performance coupled with effective expense management resulted in a 19% increase inand we continued to execute on our profit optimization efforts to help mitigate these factors. Consolidated diluted earnings per share of $2.12 and adjusted EPS diluted earnings per share of $2.30(1) increased compared to $2.17. We also delivered operatingprior year diluted earnings per share of $2.05 and adjusted diluted earnings per share of $2.16(1), respectively. Operating cash flowsflow generation of $210$167 million for the year enabled the company to fund capital expenditures supporting the business, repurchase $46 million of company shares and, subsequent to the end of the fiscal year, announce a 10% increase in the quarterly dividend to $0.1975 per share, the highest quarterly rate in Herman Miller's history.

Despite choppy industry order levels in the North America and an increaseuncertain political environment, the North America business segment delivered reported sales growth of 25% over0.6% and organic growth of 4.2%(1) compared to the prior fiscal year. A share repurchase program initiatedThe North America segment continued to deliver the highest operating margins of the company's business units. We made meaningful investments in design and innovation during the year, launching a full slate of new products and services aimed at delivering high performing solutions that meet our evolving customers’ needs.

The ELA segment recorded an increase in net sales of 12.7% for the year. After adjusting for the impact of changes in foreign currency and the impact of the extra week of operations in the 2prior fiscal year, organic net sales grew at a rate of 11.3%nd(1) quarter of fiscal 2016 andfor the recent announcementyear. The improvement in net sales reflected growth across each of our fifth dividend increasegeographic regions of EMEA, Asia-Pacific and Latin America. The ELA segment posted a decline in operating earnings of 1% relative to the past four years continues to enhance our returns to shareholders. These factors drove return on invested capital of approximately 22%prior year. However, after adjusting for the full fiscal year.impact of restructuring and other special charges, adjusted operating earnings improved by 14%(1).

Sales growth infor the North American businessSpecialty segment helped drive meaningful growth inwere 2.5% higher than prior year, as reported, and 3.9% higher than prior year on an organic basis(1). Operating earnings increased by 10% compared to the prior year, while adjusted operating earnings decreased by 45%(1). Lower profitability for the segmentNemschoff and was fairly broad based across industry sectors, with the notable exception of energy which continues to reflect that sector’s challenging economic backdrop. The Living Office framework, through new product launches, showroom re-sets, and training events during the year, reinforced our leadership in helping customers realize higher performing environments.

Our ELA business segment recorded strong organic sales growth (1) of 7%Maharam businesses for the year ledprimarily tied to lower demand levels and unfavorable product mix was partially offset by increases in China, India, Australia, Mexicooperating earnings growth for Geiger and the Middle East. A robust slate of new product launches and new manufacturing capability in India established nearHerman Miller Collection. We believe the beginning of the fiscal year positions us for further global growth.

Our Consumer segment reported sales growth of 7% over last year, although on an organic basis, segment sales were down 4% and profitability was lower than the prior fiscal year. Results were impacted by a net reduction in square footage from the beginning of the year from the closure of a number of smaller, legacy studios, lower studio revenues, pressure from actions taken to rationalize the wholesale channel, and investments in a new ERP system that provides important capabilities for the future. Design Within Reach remains well positioned to deliver long-term shareholder value through real estate transformation that is expected to increase selling square in larger format studios by nearly 100,000 square feet next year, planned launches of several exclusive product designs and a growing contract business - highlighting the potential that exists with our multi-channel strategy.

The Specialty segment posted growth in sales and profitability in fiscal 2016 across all of its businesses. The Specialty brands of Geiger, Maharam, Nemschoff and the Herman Miller Collection represent a powerful combination of inspiring brands that connect us to architect and design specifiers, expand our market opportunity in both traditional and ancillary workspaces, and serve as an increasingly important part of our economic engine.

Our Consumer segment reported strong momentum with net sales growth of 12.2% over last year, including four quarters of comparable brand(2) growth from Design Within Reach during the year and the addition of approximately 40,000 square feet of retail selling space. Growth was delivered from multiple channels this year, including studios, eCommerce, catalog and contract channels. Operating earnings and adjusted operating earnings increased by 190% and 157%(1), respectively. While the real estate expansion and investments to support long-term growth in the consumer business have limited near-term profitability over the past two years, the expansion of operating earnings this year, particularly in the second half of fiscal 2018, highlights the traction we are gaining as we scale the Consumer business.

(1) Non-GAAP measurements; see accompanying reconciliations and explanations on pg 55.

(2) DWR comparable brand sales reflects the year-over-year change in net sales across the multiple channels that DWR serves, including studios, outlets, contract, catalog, phone and e-commerce. Comparable brand growth was presented on a pro forma basis using a 52-week average to normalize results for the impact of an extra week of operations in the first quarter of fiscal 2017.

|

|

(1)Non-GAAP measurements; see accompanying reconciliations and explanations at page 54. |

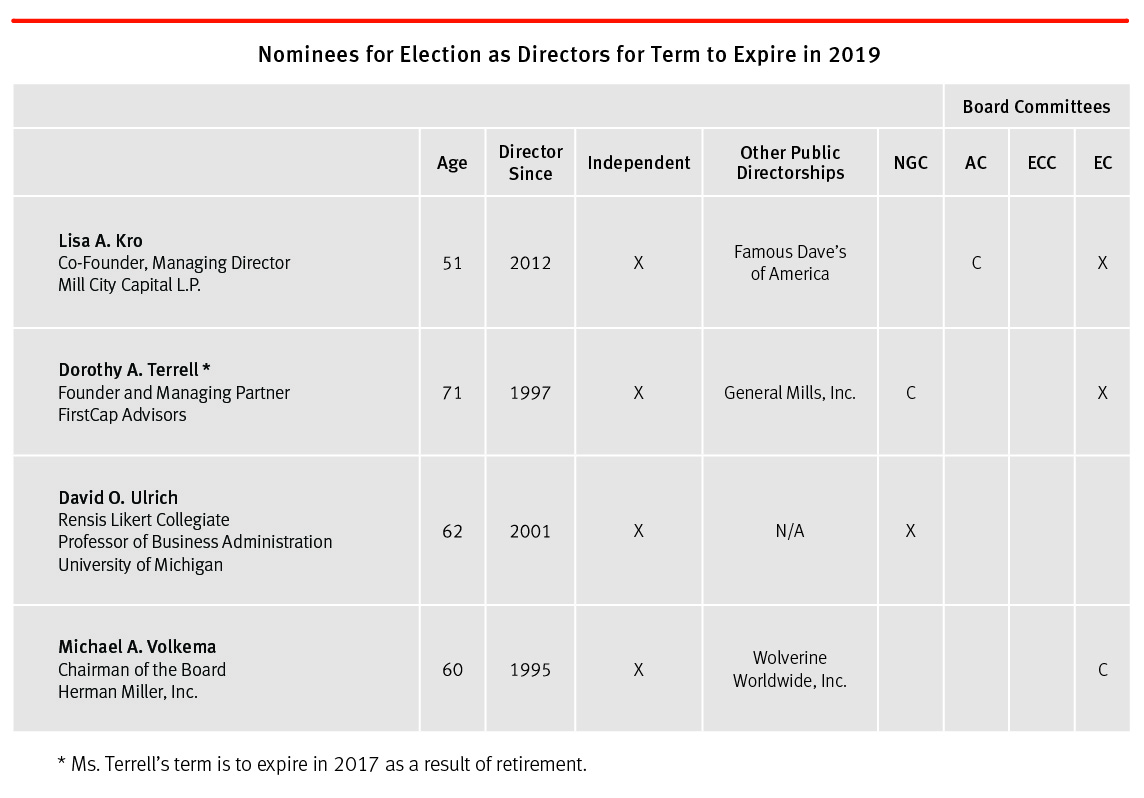

Proposal #1 - Election of Directors

The Board of Directors of the Companycompany has nominated DorothyDavid A. Terrell, Lisa A. Kro, David O. UlrichBrandon, Douglas D. French, John R. Hoke III, and Michael A. VolkemaHeidi J. Manheimer for election as directors. Ms Terrell has been nominated to serve a one-year term until the 2017 annual meeting of shareholders; the other threeAll nominees would serve until the 20192021 annual meeting. As stated in our Bylaws, a person may not be elected as a director for a term that expires later than the annual meeting after attaining age 72. As such, Ms. Terrell, who is currently 71, is being nominated for a one year term only. Each of the nominees is now serving as a director and previously has been elected as a director by our shareholders, and the Board approved each of the nominees following the recommendation of our Nominating and Governance Committee.

We include more information about the nominees and the directors who will continue in office following the Annual Meeting below. Unless otherwise directed by a shareholder’s proxy, the persons named as proxy holders in the accompanying proxy will vote for the nominees named above. If any of the nominees becomes unavailable, which we do not anticipate, then the Board of Directors, at its discretion, may designate substitute nominees, in which event your proxy will be voted for such substituted nominees unless you have withheld authority to vote for directors. Shares cannot be voted for a greater number of people than the number of nominees named.

A plurality of the votes cast at the Annual Meeting is required to elect the nominees as our directors. Accordingly, the four individuals who receive the largest number of votes cast at the Annual Meeting will be elected as directors. Shares not voted at the Annual Meeting, whether by abstention, broker non-vote, or otherwise, will not be treated as votes cast at the Annual Meeting. In an election where the only nominees are those that the Board recommended, any director who receives a greater number of votes “withheld” than those “for” must tender his or her resignation under the majority voting provisions of our Board Governance Guidelines. Under those Guidelines, the Nominating and Corporate Governance Committee will consider the resignation and recommend to the Board whether to accept or reject the tendered resignation. The Board must act on the resignation no later than 90 days after certification of the shareholder vote at that meeting. The Companycompany will publicly disclose the Board’s decision whether to accept any resignation or the reasons for rejecting the resignation, if applicable.

Following this year’s Annual Meeting of shareholders, theThe Board of Directors will consistcurrently consists of twelveten directors, nine of which elevenwhom are independent. Mr. David O. Ulrich resigned from the Board effective December 8, 2017, and Mr. Brian C. Walker is scheduled to retire as President and Chief Executive Officer and from the Board, effective August 21, 2018. The maximum number of directors for the Board is thirteen. The Amended and Restated Bylaws of Herman Miller, Inc. require that directors be divided into three classes, each class to be as nearly equal in number as possible. Members of each class hold office until the third succeeding annual meeting following their election and until their successors are duly elected and qualified or until their removal or resignation except Ms. Terrell, who will hold office for only one year.resignation.

The Board of Directors recommends a vote FOR the election of each person nominated by the Board.

|

| | | | | | | | |

| Nominees for Election as Directors for Term to Expire in 2021 |

| | Board Committees |

| | Age | Director Since | Independent | Other Public Directorships (past 5 years) | NGC | AC | ECC | EC |

David A. Brandon Former Chairman and Chief Executive Officer Toys "R" Us, Inc. | 66 | 2011 | X | Domino's Pizza, Inc. DTE Energy Company Kaydon Corporation (formerly publicly traded) | | | X | |

Douglas D. French Managing Director Santé Health Ventures | 64 | 2002 | X | N/A | X | X | | |

John R. Hoke III Vice President Global Design Nike, Inc. | 53 | 2005 | X | N/A | | | X | |

Heidi J. Manheimer Executive Chairman of Surratt Cosmetics, LLC | 55 | 2014 | X | N/A | | X | | |

|

| | | | | | | | |

| Directors Whose Term Expires in 2019 |

| | Board Committees |

| | Age | Director Since | Independent | Other Public Directorships (past 5 years) | NGC | AC | ECC | EC |

Lisa A. Kro Co-Founder, Managing Director Mill City Capital L.P. | 53 | 2012 | X | Famous Dave's of America, Inc. | | C | | X |

Michael A. Volkema Chairman of the Board Herman Miller, Inc. | 62 | 1995 | X | Wolverine Worldwide, Inc. | | | | C |

|

| | | | | | | | |

| Directors Whose Term Expires in 2020 |

| | Board Committees |

| | Age | Director Since | Independent | Other Public Directorships (past 5 years) | NGC | AC | ECC | EC |

Mary Vermeer Andringa Chief Executive Officer and Board Chair Vermeer Corporation | 68 | 1999 | X | N/A | C | | | X |

Brenda Freeman Chief Marketing Officer Magic Leap | 54 | 2016 | X | Caleres Inc. Under Armour, Inc | X | | | |

J. Barry Griswell Retired, President and Chief Executive Officer Community Foundation of Greater Des Moines | 69 | 2004 | X | Voya Financial Inc. OZ Management | | | C | X |

Andrea Owen President and Chief Executive Officer Herman Miller, Inc. | 53 | 2018 | | Taylor Morrison Home Corporation | | | | |

| NGC: Nominating and Governance Committee AC: Audit Committee ECC: Executive Compensation Committee EC: Executive Committee C: Chair X: Member | | | | | | | | |

Information about the Nominees and Directors

Certain information with respect to the nominees for election at Annual Meeting, as well as each of the other Directors, is set forth below and on the following pages, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person held during the last five years, and the year in which each person became a Director of the Company. Additionalcompany. We also include additional information below and on the following pages about each continuing Director is also included that describesdescribing some of the specific experiences, qualifications, attributes or skills that each Director possesses which the Board believes has prepared them to be effective Directors.

|

| | | | |

Nominees for Election as Directors for Term to Expire in 20192021 |

| Name and Age | Year First Became a Director | Principal Occupation(s) During Past 5 years | Other Directorships of Public Companies held during Past 5 years |

| | | |

Lisa A. Kro, 51 | 2012 | Co-Founder, Managing Director | Famous Dave's of America |

| | Mill City Capital L.P. since 2010 | |

| | Managing Director and CFO, Goldner Hawn Johnson & Morrison | |

| | 2004 to 2010 | |

| | | |

Ms. Kro is a founding partner of Mill City Capital, L.P., a private equity firm, where she is Managing Director. From 2004 to 2010, Ms. Kro was the Chief Financial Officer and a Managing Director of Goldner Hawn Johnson & Morrison, also a private equity firm. Prior to joining Goldner Hawn, she was a partner at KPMG LLP, an international public accounting firm.

Ms. Kro's service in auditing as well as her experience in the finance and capital environments enable her to contribute to a number of financial and strategic areas of the Company. Her experience on other boards, including previous service as the financial expert on the audit committee of another publicly-traded company, contributes to the oversight of the Company's financial accounting controls and reporting; accordingly, the Board recommended her nomination for re-election as a director.

|

| | | |

| | | |

Dorothy A. Terrell, 71 | 1997 | Founder and Managing Partner, FirstCap Advisors | General Mills, Inc. |

| | since 2010 | |

| | Venture Partner, First Light Capital | |

| | from 2003 to 2010 | |

| | | |

Ms. Terrell is the Founder and Managing Partner of FirstCap Advisors, a venture capital and advisory firm committed to helping innovative technology companies move successfully through the critical early stages of product and business development. Prior to this she was a Partner at First Light Capital, a venture capital fund investing in early stage products and service companies in enterprise software and integration, communications and business-to-business e-commerce. Concurrent with her service to First Light Capital, she was President and CEO of the Initiative for a Competitive Inner City, a national not-for-profit organization. Ms. Terrell has over twenty-five years of experience in the technology industry. At NMS Communications she was Senior Vice President of Worldwide Sales and concurrently President of Platforms & Services Group. She was also a Corporate Officer at Sun Microsystems, Inc. and President of its subsidiary, SunExpress.

Ms. Terrell's experience as a senior executive, her knowledge and service in the technology arena and service to other boards led the Board of Directors to recommend that she continue to serve as a director.

|

| | | |

| | | |

David O. Ulrich, 62 | 2001 | Professor, University of Michigan since 1982 | None |

| | | |

Dr. Ulrich is the Rensis Likert Collegiate Professor of Business Administration at the University of Michigan. He also provides counsel to more than half of the Fortune 200 companies, focusing on strategic management and competitive advantage issues as well as human resource management, leadership culture and talent. He has published thirty books and hundreds of articles on these and related topics.

Dr. Ulrich's academic research and consulting on strategic management and other business issues, among other factors, contributed to the recommendation by the Board of Directors that his service continue as a director.

|

|

| | | |

| | | |

Michael A. Volkema, 60 | 1995 | Chairman of the Board, Herman Miller, Inc. | Wolverine Worldwide, Inc. |

| | since 2000 | |

| | | |

Mr. Volkema has been Chairman of the Board of Directors of Herman Miller, Inc. since 2000. He also served as CEO and President of the Company from 1995 to 2004. Mr. Volkema has more than thirty years of experience as a senior executive in the home and office furnishings industry. This experience includes corporate leadership, branded marketing, international operations, and public company finance and accounting through audit committee service.

Mr. Volkema is a key contributor to the Board based upon his knowledge of the Company's history and culture, operational experience, board governance knowledge, service on boards of other publicly held companies and industry experience. These factors contributed to his recommendation by the Board for continued service as a director. |

| | | |

|

| | | |

Directors Whose Terms Expire in 2017 |

Name and Age | Year First

Became

a Director

| Principal Occupation(s) During Past 5 years | Other Directorships of Public Companies

held during Past 5 years

|

| | | |

Mary Vermeer Andringa, 66 | 1999 | Chair of the Board | None |

| | Vermeer Corporation since November 2015 | |

| | Chief Executive Officer and Chair of the Board | |

| | Vermeer Corporation from November 2014 to October 2015 | |

| | President and Chief Executive Officer | |

| | Vermeer Corporation from 2003 to October 2014 | |

| | | |

Since 1989, Ms. Andringa has been an executive officer of Vermeer Corporation, a leading manufacturer of agricultural, construction, environmental and industrial equipment located in Pella, Iowa. She served as President and Chief Executive Officer of Vermeer from 2003 to November 2014. At that time she became Chief Executive Officer and Chair of the Board. She transitioned exclusively to Chair of the Board in November 2015. Ms. Andringa's tenure with Vermeer has spanned the gamut of functional expertise from marketing to international sales and acquisitions. With over thirty years of manufacturing experience, Ms. Andringa is past Chair of the National Association of Manufacturers which represents over 10,000 U.S.-based manufacturing entities.

Ms. Andringa's experience as a chief executive officer coupled with her focused efforts on lean manufacturing and continuous improvement initiatives as well as her involvement in international product sales and distribution provides an important resource to management and the Board of Directors.

|

| | | |

| | | |

Brenda Freeman, 47 | 2016 | Chief Marketing Officer, National Geographic Channel | Under Armour, Inc. |

| | since February 2015 | |

| | Global Head of Television Marketing, DreamWorks Animation SKG | |

| | April 2014 to February 2015 | |

| | Chief Marketing Officer, Turner Animation | |

| | 2008 to April 2014 | |

| | | |

Ms. Freeman is the Chief Marketing Officer for National Geographic Channel and Nat Geo Wild. Previously, Ms. Freeman was Global Head of Television Marketing for DreamWorks Animation. Prior to DreamWorks Animation, Ms. Freeman spent six years at Turner Broadcasting, most recently as Chief Marketing Officer for Turner Animation, Young Adults and Kids Media. Before that she served as SVP of Integrated Marketing and Promotions for the Nickelodeon MTVN Kids and Family Group. She was appointed to the Board of Directors of Herman Miller, Inc. in January 2016.

Ms.Freeman's experience as marketing executive and her specific experience with the digital marking and programming brings significant strength to the Board in advising management as it develops and executes the company’s brand and demand pull marketing strategies.

|

| | | |

| | | |

J. Barry Griswell, 67 | 2004 | President and CEO, Community Foundation of Greater | Och-Ziff Capital Management |

| | Des Moines 2008 to 2013 | Group LLC |

| | | Voya Financial Inc. |

| | | National Financial Partners Corp. |

| | | |

Mr. Griswell is the retired Chairman and Chief Executive Officer of the Principal Financial Group and Principal Life, a global financial services provider which offers a wide range of insurance and financial products and services. With more than thirty years of financial services experience, Mr. Griswell was the President and CEO of MetLife Marketing Corporation prior to joining The Principal. He is a former director and non-executive chairman of the board of the Principal Financial Group. Mr. Griswell is currently a director of Och-Ziff Capital Management Group where he serves as the chair of the Executive Compensation Committee, and is a member of the Audit Committee and the Nominating and Governance Committee. He also is a director of Voya Financial where he serves on the Audit Committee and the Nominating and Governance Committee and as chair of the Executive Compensation and Benefits Committee.

Mr. Griswell's financial expertise, governance experience and service as an executive of a publicly-traded corporation make him a key contributor to the Board of Directors.

|

|

| | | |

| | | |

Brian C. Walker, 54 | 2003 | President and Chief Executive Officer | Briggs & Stratton Corporation |

| | Herman Miller, Inc. since 2004 | Universal Forest Products |

| | | |

Since 2004, Mr. Walker has served as President and Chief Executive Officer of the Company. Previously, he held other executive leadership positions with the Company having served as the Chief Operating Officer of Herman Miller Inc., President of Herman Miller North America and Chief Financial Officer. Mr. Walker is a Certified Public Accountant and serves as the lead director and chairs the Compensation Committee of Briggs & Stratton Corporation.

Mr. Walker is the only member of Company management on the Board of Directors, which provides an important link to the Company's ongoing business operations and challenges. Moreover, Mr. Walker's knowledge of the Company's history and culture, operational and executive leadership roles with the Company, accounting acumen and governance experience make him an important contributor to the Board's deliberations.

|

| | | |

|

| | | | |

Directors Whose Terms Expire in 2018 |

Name and Age | Year First

Became

a Director

| Principal Occupation(s) During Past 5 years | Other Directorships of Public Companies

held during Past 5 years

|

| | | |

David A. Brandon, 6466 | 2011 | Chairman and CEO, Toys "R" Us, Inc. | Domino's Pizza, Inc. |

| | | since July 2015 to 2018 | DTE Energy Company |

| | | Director of Intercollegiate Athletics, University of Michigan | Kaydon Corporation |

| | | 2010 to October 2014 | (formerly publicly traded) |

| | | | |

Mr. Brandon is the former Chairman and Chief Executive Officer of Toys "R" Us, Inc., a retailer of toys and juvenile products. Mr. Brandon joined Toys "R" Us in 2015 and officially left the company in May 2018. On September 18, 2017, Toys "R" Us filed a voluntary petition for relief under the United States Bankruptcy Code in the United States Bankruptcy Court for the Eastern District of Virginia (Richmond Division). Mr. Brandon served as the Director of Intercollegiate Athletics at the University of Michigan from 2010 to October 2014. Prior to that, he served as Chairman and Chief Executive Officer of Domino's Pizza, Inc., an international pizza delivery company operating over 9,000 stores in over 60 countries. Mr. Brandon was also President and Chief Executive Officer of Valassis, Inc. from 1989 to 1998 and Chairman of its Board of Directors from 1997 to 1998. Mr. Brandon's years of experience as a Chief Executive Officerchief executive officer of several publicly-traded companies, his experience in global brand management and his for-profit and non-profit board service bring a unique perspective to the Board of Directors. These factors contributed to his recommendation by the Board for continued service as a director. |

|

| | | | |

Douglas D. French, 6264 | 2002 | Managing Director, Santé Health Ventures | None |

| | | since 2007 | |

| | | | |

Mr. French has served as the founding partner of Santé Health Ventures, an early-stage healthcare venture fund, since 2007. Prior to joining Santé Health Ventures, he served as the President and Chief Executive Officer of Ascension Health, the largest not-for-profit health system in the U.S. Mr. French has also served as CEO for St. Mary's Medical Center and St. Vincent Health System, both of midwestMidwest Indiana. He has more than three decades of health management experience including serving as a director for numerous public and private companies. Mr. French's governance experience, as well as his leadership roles and expertise in the health management industry, provides a valuable resource to management and the Board of Directors.Directors; accordingly, the Board recommended his nomination for re-election as a director. |

| | | |

| | | |

John R. Hoke III, 5153 | 2005 | Vice President,Chief Design Officer, Nike, Global Design,Inc. | None |

| | | since 2017 | |

| | Vice President, Nike Global Design 2010 to 2017 | |

| | | | |

Since joining Nike, Inc., a marketer of athletic footwear, apparel, equipment, accessories and services, in 1993, Mr. Hoke has led the communication of Nike's culture of creativity internally and externally. He is currently the Chief Design Officer of Nike, Inc. having previously served as Vice President of Global Design, inspiring and overseeing an international team of designers. Mr. Hoke also serves as a director to several not-for-profit organizations relating to art and design. Mr. Hoke's design expertise, both domestically and internationally, including his leadership role in a major, global enterprise, brings additional, insightful perspective to our Board discussions and decisions.decisions, and contributed to his recommendation by the Board for continued service as a director. |

| Heidi J. Manheimer, 55 | 2014 | Executive Chairman, Surratt Cosmetics LLC | None |

| | since December 2017 | |

| | | | |

Heidi J. Manheimer, 53 | 2014 | Independent Consultant since October 2015 to 2017 | None |

| | | Chief Executive Officer, Shiseido Cosmetics America | |

| | | | from 2006 to September 2015 | |

| | | | |

Ms. Manheimer is the Executive Chairman of Surratt Cosmetics LLC, a customizable beauty products and cosmetics company. Ms. Manheimer served as the Chief Executive Officer of Shiseido Cosmetics America, a global leader in skincare and cosmetics, from January 2006 to September 2015, as President of U.S. Operations from 2002 to 2006 and as Executive Vice President and General Manager from 2000 to 2002. Prior to that she spent seven years at Barney's New York and seven years at Bloomingdales in the beauty care divisions, rising to senior leadership positions within each company. Ms. Manheimer currently sits on the Board of Directors of Burton Snowboards having been appointed in 2006. For many years, she has served on nonprofit and trade association boards, and she was elected Chairwoman of the Cosmetic Executive Women Foundation in 2014.

Ms. Manheimer’s extensive experience as a senior executive in the retail industry, experience with both e-commerce and international business practices and service as a board member for both profit and nonprofit businesses ledprovide a valuable resource to management and the Board of Directors, accordingly, the Board recommended her nomination for re-election as a director. |

|

| | | |

| Directors Whose Terms Expire in 2019 |

| Name and Age | Year First Became a Director | Principal Occupation(s) During Past 5 years | Other Directorships of Public Companies held during Past 5 years |

| | | |

| Lisa A. Kro, 53 | 2012 | Co-Founder, Managing Director | Famous Dave's of America, Inc. |

| | Mill City Capital L.P. since 2010 | |

| | | |

Ms. Kro is a founding partner of Mill City Capital, L.P., a private equity firm, where she is Managing Director. From 2004 to 2010, Ms. Kro was the Chief Financial Officer and a Managing Director of Goldner Hawn Johnson & Morrison, also a private equity firm. Prior to joining Goldner Hawn, she was a partner at KPMG LLP, an international public accounting firm.

Ms. Kro's service in auditing as well as her experience in the finance and capital environments enable her to contribute to a number of financial and strategic areas of the company. Her experience on other boards, including previous service as the financial expert on the audit committee of another publicly-traded company, contributes to the oversight of the company's financial accounting controls and reporting. |

|

| | | |

| | | |

| Michael A. Volkema, 62 | 1995 | Chairman of the Board, Herman Miller, Inc. | Wolverine Worldwide, Inc. |

| | since 2000 | |

| | | |

Mr. Volkema has been Chairman of the Board of Directors of Herman Miller, Inc. since 2000, serving as non-executive Chairman since 2004. He also served as CEO and President of the company from 1995 to 2004. Mr. Volkema has more than thirty years of experience as a senior executive in the home and office furnishings industry. This experience includes corporate leadership, branded marketing, international operations, and public company finance and accounting through audit committee service.